With a robust CAGR of 28.5%, the cryptocurrency mining market has become a lucrative option for businessmen worldwide. The market is to surpass $5293.9 Million by the end of Forecast 2028, says PRNewswire.

In the world of cryptocurrencies and blockchain technology, Argo Blockchain has emerged as a prominent player, raising eyebrows and igniting discussions among investors.

With the buzz around digital assets reaching a fever pitch, you might be wondering: Is Argo Blockchain a smart investment choice?

Before we dive into this intriguing subject, let’s get some background.

Argo Blockchain is a UK-based company specializing in cryptocurrency mining and related services. As the crypto landscape continually reshapes traditional financial markets, Argo’s role in this digital revolution is compelling.

But, is it a wise investment?

To answer that question, we’ll explore Argo’s journey, its standing in the crypto industry, and factors to consider when deciding if it’s the right fit for your investment portfolio.

Table of Contents

What is Argo Blockchain?

Argo Blockchain is a technology company that provides blockchain solutions for businesses. Their goal is to simplify companies’ use of blockchain technology to streamline their operations and reduce costs. So, is Argo Blockchain a good investment?

Agro Blockchain is a publicly traded blockchain technology company specializing in large-scale cryptocurrency mining. The company’s headquarters is in the United Kingdom, in London, and it is the only cryptocurrency mining company listed on the London Stock Exchange.

Blockchain technology possesses the potential to revolutionize the future of the world, and Agro Blockchain is committed one hundred percent to take it forward sustainably. The company has highly energy-efficient mining operations strategically positioned across North America.

Tap into Lucrative Opportunities! Position your business for success in the booming crypto mining industry.

Eco-Friendly Aspects of Argo Blockchain

Arguably, one of the most important aspects of any business is its environmental impact. Argo Blockchain, a bitcoin mining company, is doing its part to help reduce its carbon footprint. The company has preferred renewable energy sources such as solar and hydropower.

Argo Blockchain is also working on making its mining operations more efficient so that less energy is required to run them. These eco-friendly initiatives make Argo Blockchain a good investment for those interested in supporting businesses working to reduce their environmental impact.

The company reduced its greenhouse gas emissions by becoming carbon neutral and supporting projects outside its group to make it more environmentally friendly.

Therefore, it became the first publicly traded cryptocurrency miner to be climate positive from scopes one, and two, and greenhouse gas emissions from the value chain associated with its mining operations.

It proved a significant development in the company’s long-term climate strategy, covering not only existing energy efficiency initiatives but also upcoming ones.

Among the initiatives are reducing e-waste, using waste heat in collaboration with local municipalities, and the appropriate industry support by maintaining sustainability standards.

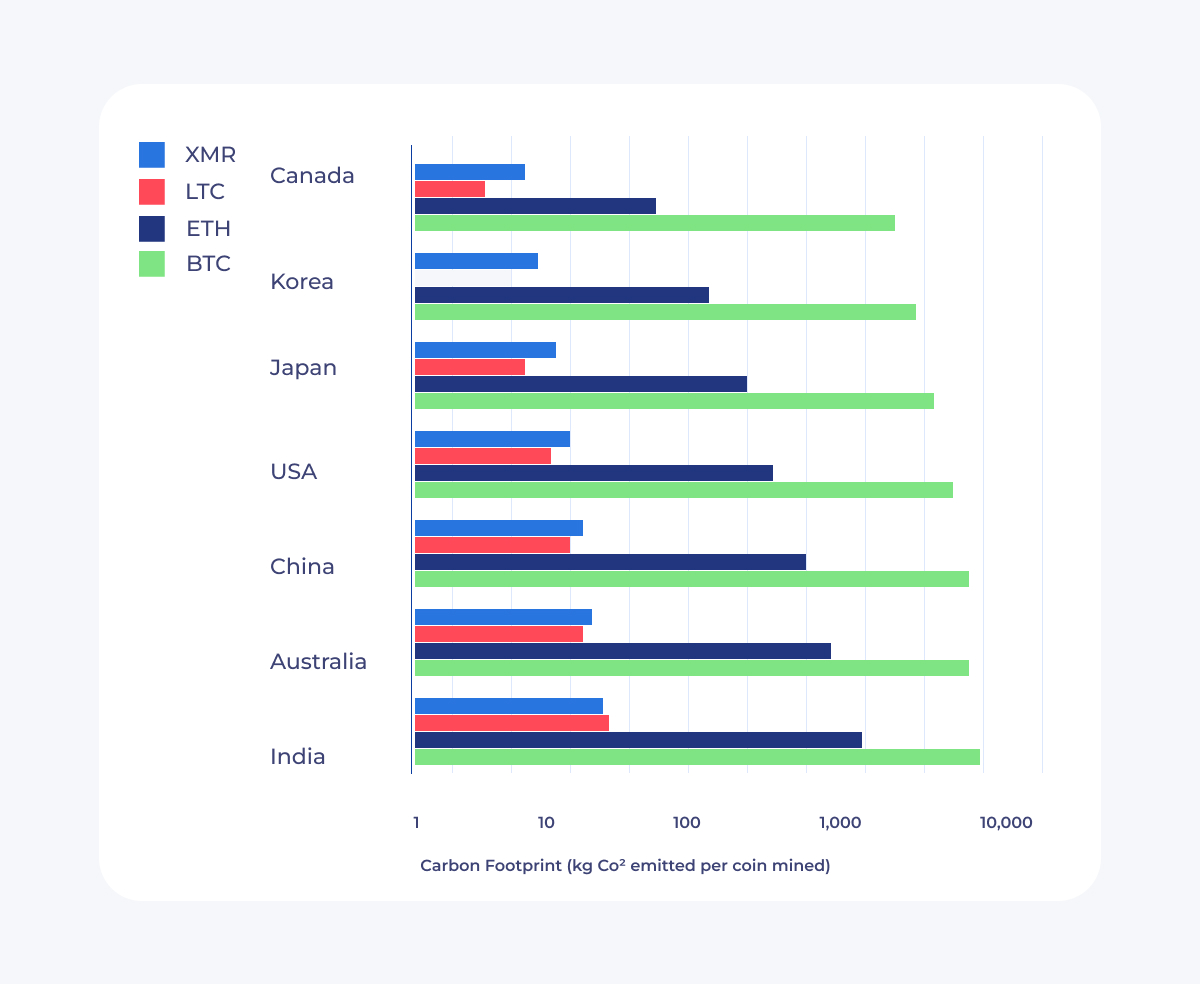

Carbon Footprint of Cryptomining – Present Scenario

It is impossible to calculate precisely how much energy is used for Bitcoin and cryptocurrency mining. Still, an approximation can be made from the network’s hash rate and the power consumed by commercially-available mining rigs.

According to Cambridge Bitcoin Electricity Consumption Index, Bitcoin, the most popularly mined cryptocurrency network, used 85 Terawatt-hours (TWh) of electricity (0.38% of global electricity) and about 218 TWh of energy (0.13% of global energy production) during production.

Calculating the carbon footprint of cryptocurrency is a bit more complicated. Although fossil fuels are the primary energy source in most countries where cryptocurrency is mined, miners must find the cheapest energy sources to remain profitable. In many cases, this will involve the increasing use of alternative energy sources.

Digiconomist calculates that the Bitcoin network is responsible for 73 million tons of carbon dioxide per year—equal to the emissions of Turkmenistan. Mining for Ethereum produces an estimated 35.4 million tons of carbon dioxide emissions—roughly the same as New Zealand’s.

However, unlike other Bitcoin mining operations, which consume large quantities of fossil fuels and produce carbon emissions, Argo Blockchain is creating environmentally responsible solutions. For example, Peter Wall, who is Argo’s chief executive, led a tour of the 126,000-square-foot construction site one morning this month; he invested in a row of wind turbines a few miles down the road.

Also Read: Blockchain Development Cost – Blockchain Pricing

Decoding Cryptocurrencies

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and control the creation of new units. Cryptocurrencies are decentralized, so they are not subject to government & financial institution control.

As a crypto mining company, Argo blockchain provides short-term (daily) and long-term (annual) contracts for those looking to enter the industry. They offer one contract plan for those looking for short-term mining opportunities and two different methods for those who want to mine over a more extended period.

The average return rate is 1% daily, with an annual yield of about 12%. Withdrawals are only allowed once daily and take approximately 24 hours to process; this may be inconvenient for some investors.

A Detailed Look at the Crypto Mining Process

The cryptocurrency market is booming, and everyone wants in. One of the common ways to jump into crypto is mining? Crypto mining, like traditional mining, is still an emerging industry.

Currently, there are several different methods of digital currency mining—each with its upsides and downsides. The two major digital currency miners are hardware miners (designed for large-scale operations) and paper wallets (intended for home use).

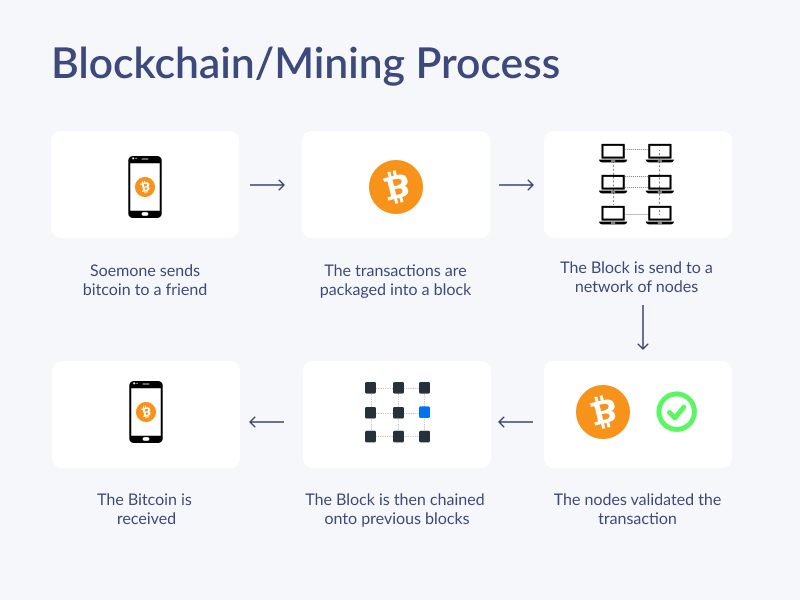

The following steps are involved in a typical Crypto mining process:

- Individuals and devices creating a blockchain verify whether the transactions are legitimate

- Separate transactions are added to a list of other trades that contribute to the formation of a block

- A hash or other data is then added to the block that is still unconfirmed

- To make sure the block so formed is legitimate, the crypto miners verify the block’s hash

- Blockchains are published after the confirmation of the block

- With public-key cryptography, all transactions on the ledger are encrypted

For the blocks to be accepted, the crypto-mining nodes on the blockchain must use a hash to verify that each block is genuine and unaltered.

Explore Crypto Mining with Confidence. Partner with Experienced Professionals..

What is Different in Crypto Mining at Argo Blockchain?

Argo Blockchain is a mining company that uses both traditional and cloud-based mining rigs. They offer a variety of plans, including both short-term and long-term, so that you can choose what best fits your needs.

While Argo Blockchain has been around for less than two years, they have quickly become one of the largest mining companies in the world.

Unlike other crypto mining companies that fail to recognize their environmental responsibilities, Argo blockchain has taken a step ahead by taking care of its environmental responsibilities.

The management team at this company does not believe in producing more carbon dioxide than the environment can handle, which is why it takes steps to reduce emissions from its operational activities.

One example of how this company reduces emissions from operational activities is by using renewable energy sources such as solar panels on their property. Furthermore, they monitor how much power they use to ensure it doesn’t exceed 110% of the electrical grid’s capacity. In conclusion, Argo Blockchain seems a good investment because it’s profitable with competitive returns and good customer service reviews.

The Verdict – Does Argo Blockchain Offer Value?

Argo Blockchain is a cryptocurrency mining company. It was established in 2017 and is headquartered in the United Kingdom. It operates two mining centers in Quebec, Canada. Argo’s main plans are Starter, Standard, and Pro.

All plans offer lifetime contracts and have no maintenance fees. The company has been profitable since its inception and has paid over $10 million in dividends to shareholders since 2018. Overall, we believe Argo Blockchain is a decent investment for those looking to invest in cryptocurrency mining.

How to Create your Own Crypto Mining Company

If you’re looking to get into the cryptocurrency mining business, there are a few things you need to know. A cryptocurrency mining company requires a handful of investment upfront for equipment and facilities that can run for years and even decades with proper upkeep.

- One of the main components is a mining rig, an energy-intensive computer that does calculations 24/7.

- These rigs are notoriously loud and power-hungry, so an adequate cooling system needs to be set up to prevent them from overheating and burning out too quickly.

- They also require constant upgrades as they use more electricity than they generate in Bitcoin over time.

Outsourcing to Blockchain development companies in India proves cost-effective as they offer better rates. Having someone on your side with experience developing solutions for this new technology is always reliable. Risk management is the first rule when dealing with any venture; never invest what you can’t afford to lose, and always take calculated risks!

The steps to creating the crypto mining company involve the following:

Step 1: Plan your Bitcoin Mining Business

As a businessman, you need a clear plan to map out the details of your business and identify some unknowns. The following are a few essential topics to consider:

- How much will the startup and ongoing costs be?

- Which market do you want to reach?

- Is it possible to charge customers a certain amount?

Step 2: Transform the Bitcoin Mining Business into a Legal Entity

Having the correct legal entity set up before making any investments is vital. For example, if you choose to form a corporation, you’ll need articles of incorporation filed with the Secretary of State and bylaws detailing how your corporation operates.

Step 3: Set Up a Bank Account

Make sure you have access to sufficient funds to pay for all expenses related to running your bitcoin mining business until revenue starts coming in. Create a list of potential partners or employees and start networking now. You may not find what you need overnight, but if you start talking about this opportunity now, people who are interested later down the line may come forward!

Step 4: Register the Taxes

In the United States, cryptocurrencies are classified as property. So, anytime you buy and sell a cryptocurrency, you complete a property transaction. And yes, this includes paying taxes. When you hold cryptocurrencies long-term, you should record each trade (buy and sell) and report the gain or loss to your income tax return every year.

Step 5: Don’t Neglect Essential Permits & Licenses

Having your own crypto mining company is exciting, but obtaining all necessary licenses and permits is essential so you can operate safely. Depending on your state or nation, you may need to file for sales tax permits or work with your local planning commission. Remember that state and federal governments want to protect their citizens, which means they’ll want proof that you’re up-to-date on regulations. So make sure you have your ducks in a row before launching!

Step 6: Insurance is your Escape Out Plan

With the volatile nature of cryptocurrencies, there is always a chance that something could go wrong. Having your back covered is essential, as knowing that you can easily walk away if the deal doesn’t feel right or things are going south. There are several ways to ensure your bitcoin mining business, depending on what it entails and the likelihood of it happening.

Step 7: Build Credibility & Brand Value

It is crucial to build credibility and brand value from the beginning. Engage with your target audience. Ask for feedback, respond to comments, and provide updates for followers who want to hear more about the bitcoin mining business. It helps establish a trusting relationship.

Another way you can build credibility is through social media. Like any marketing campaign, you must post on the proper channels and use hashtags to get your content in front of a wider audience.

Read Also: Blockchain Trends 2022: In-Depth Industry & Ecosystem Analysis

Wrapping Up

Once your bitcoin mining business runs smoothly, you can start enjoying profits while keeping an eye on overhead costs and other potential risks. Always check what your suppliers offer, keep an eye on costs, and ask for volume discounts where possible. Also, pay attention to seasonal changes in Bitcoin value; as demand increases, so will your earnings!

Establishing a crypto mining company requires technical expertise. Hire blockchain developers in India that don’t just develop but can help you with the entire business idea & development process.

Improve your security while minimizing cybersecurity risks.

Frequently Asked Questions

Question: Is Argo Blockchain a good investment?

Answer: Argo Blockchain’s revenues are growing, and its EBIT margins increased by 46.9 percentage points to 58% over the past year. That’s fantastic news. Here are the earnings and revenue growth charts for the company over time.

Question: What does Argo Blockchain do?

Answer: Crypto-mining service provider Argo Blockchain PLC became the first company to receive a standard listing on the primary market of the London Stock Exchange. The UK-based company operates a global data center that offers low-cost mining of leading crypto-currencies.

Question: Is Argo Blockchain mining Bitcoin?

Answer: Yes, the company mines Bitcoin.