In recent years, the banking and financial technology (FinTech) sector has witnessed a significant shift due to the integration of Artificial Intelligence (AI). The impact of AI on our economic interactions and management has been revolutionary.

According to Business Research, there has been substantial growth in the AI for Fintech market, rising from $9.15 billion in 2022 to an impressive $11.59 billion in 2023, registering a cumulative annual growth rate (CAGR) of 26.8%.

AI, with its transformative influence and capabilities, has elevated the industry’s efficiency and effectiveness to a new level. It has empowered banks and financial institutions to rely on data-driven decisions, facilitating personalized experiences.

In this blog, we will delve into the substantial effect AI has had on the FinTech industry, highlighting how it has redefined the dynamics of the banking and financial ecosystem.

Table of Contents

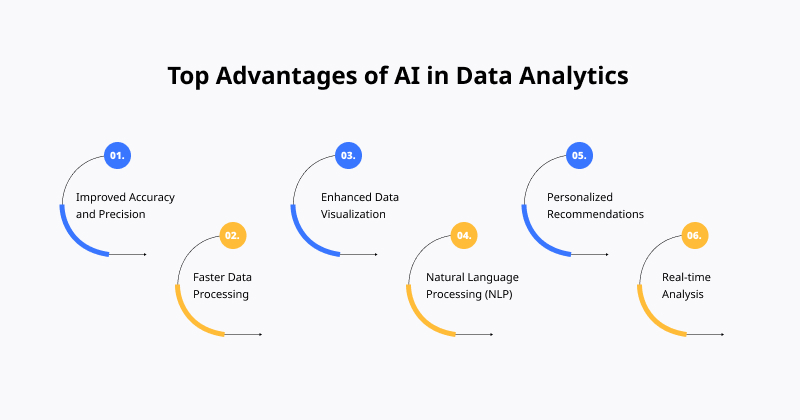

Benefits of Using AI-powered Financial Solutions

Leveraging AI-powered financial solutions has become a critical strategy for maintaining competitiveness and providing outstanding value to customers in the continuously changing industry. Let’s examine the several benefits of using AI in financial processes.

Enhanced Customer Service

AI-powered financial solutions allow round-the-clock client service, reducing response times and offering prompt resolutions to questions, problems, and transactions.

For instance, many banks now communicate with clients through AI chatbots. HDFC offers 24/7 individualized service to consumers by answering questions about balances, transaction histories, and expenditure analysis.

Personalized Financial Advice

AI-driven customer experience improves user happiness and financial progress using client data to provide individualized investment suggestions and financial guidance.

For instance, the robo-advisor platform Wealthfront uses AI algorithms to evaluate its client’s goals, risk tolerance, and financial circumstances. It offers customized investment portfolios to maximize returns.

Fraud Detection and Prevention

AI and financial data analysis may quickly identify odd patterns or abnormalities in financial transactions, improving security and lowering the possibility of fraud.

For instance, Mastercard employs AI to track transactions and look for indications of fraudulent activity. Users can be shielded against unauthorized card use by its real-time ability to recognize and stop questionable transactions.

Automated Document Processing

AI-driven customer experience reduces human error and saves time by processing and extracting data from large volumes of financial documents quickly and accurately.

For example, businesses that handle invoices, such as AppZen, utilize AI to extract data from receipts, invoices, and other financial documents. This automation streamlines businesses’ accounts payable procedures.

Improved Investment Decisions

Fintech AI trends can offer insights into market patterns and investment opportunities, helping investors make well-informed decisions by analyzing large datasets.

For example, the investing platform Wealthsimple uses AI algorithms to maximize asset allocation and make real-time modifications based on market data. It makes it more likely that investors will get profitable returns.

Risk Assessment and Management

AI-powered financial solutions assist financial organizations in assessing risk more accurately and minimizing potential losses by evaluating risk factors and modeling scenarios.

For instance, big insurance providers like Allstate determine insurance rates and evaluate risks using AI models. These models use a variety of variables to decide policy pricing, including credit ratings and driving behaviors.

Automated Compliance Monitoring

AI for fintech lowers the risk of fines and legal problems by streamlining regulatory compliance by tracking transactions and activities in real time.

For example, ComplyAdvantage uses AI to assist financial institutions in monitoring transactions and client information for possible fraud or money laundering. It keeps an eye out for any questionable activity and alerts any regulatory compliance continuously.

Uplift your customer engagement with PixelCrayons' AI consulting.

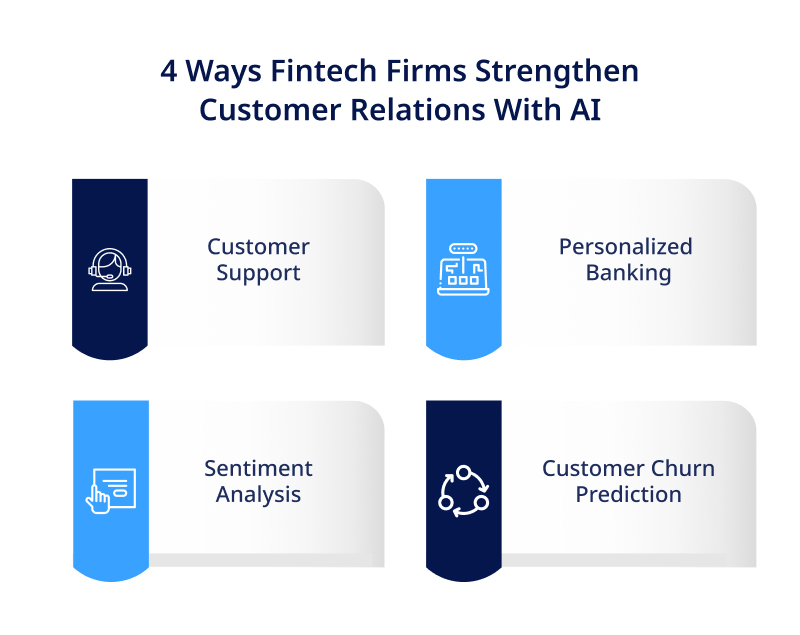

Ways Fintech Firms Are Strengthing Customer Relations with AI

AI-based data-driven insights for the fintech industry act as a significant innovation driver in the fintech industry, which is undergoing a revolutionary shift. Fintech companies are transforming client connections by utilizing artificial intelligence in financial services.

Here are a few crucial ways they are doing it:

Customer Support

Fintech companies use AI-driven chatbots and virtual assistants to offer 24/7 client service. These chatbots can aid with purchases, answer questions, and lead users through different steps. They ensure client complaints are immediately resolved, improve efficiency, and provide immediate solutions.

Personalized Banking

Fintech companies can offer highly customized banking experiences because of AI. By examining consumer data, AI systems determine spending patterns, investment preferences, and financial objectives.

Fintech platforms may provide personalized banking with AI financial goods and services with the help of this information, which raises client happiness and engagement levels.

Sentiment Analysis

Fintech businesses use AI-powered sentiment analysis to learn about consumer preferences and fintech AI trends.

They can determine how the general public feels about their services and goods by watching social media, news, and customer reviews. AI for fintech enables them to modify their tactics, enhance their products, and remain aware of the demands of their clients.

Customer Churn Prediction

Predictive analytics powered by AI forecast consumer behavior, including churn risk. By AI and financial data analysis, its models can spot warning signs that a user might abandon a platform.

Fintech companies can proactively pursue customer retention by offering tailored or enhanced services.

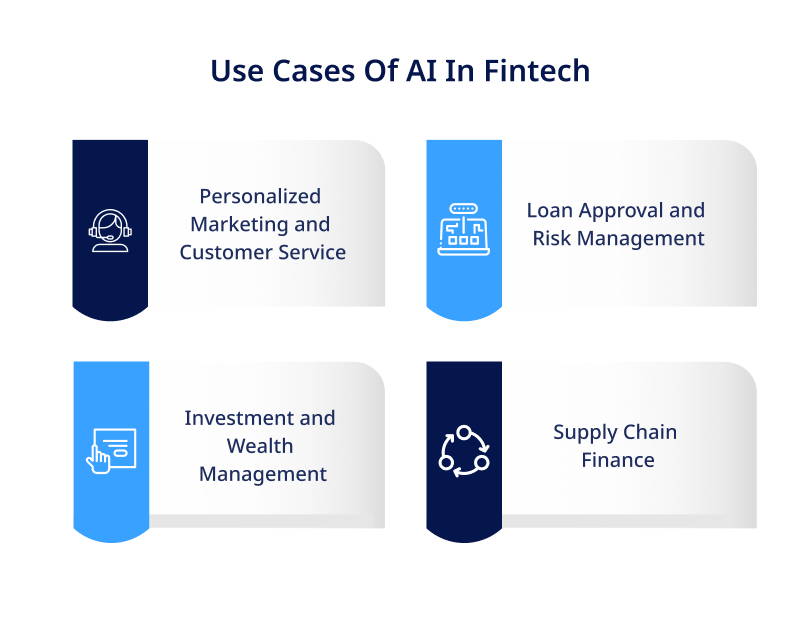

AI Uses Cases in Fintech

In the fintech sector, artificial intelligence has shown to be a revolutionary force, transforming several financial services.

AI for fintech firms is reshaping operations and interacting with customers through advanced algorithms and machine learning. Here are some critical use cases where AI is making a significant impact:

Personalized Marketing and Customer Service: Artificial intelligence (AI) powered chatbots and virtual assistants can provide 24/7 customer support by quickly answering customer queries and fixing issues.

Shorter response times could result in happier customers. Fintech AI may also leverage user data, including past transactions, search histories, and social media activity, to provide personalized marketing and recommendations, making the user experience more engaging.

Loan Approval and Risk Management: AI for fintech can process massive volumes of data to assess a borrower’s creditworthiness and identify possible risks.

For instance, by using AI for fintech, it is possible to assess a borrower’s likelihood of loan default by looking at their employment status, credit history, and other variables. Fintech companies have less risk of losing money while making loan choices.

Investment and Wealth Management: AI for fintech software development businesses in India provides customized financial recommendations to customers by analyzing market data and accounting for attributes such as an individual’s investing goals, risk tolerance, etc.

As a result, there may be an improvement in customer satisfaction and investment performance.

Supply Chain Finance: By eliminating the need for human processing and improving the speed and accuracy of financing decisions, automating the financing of invoices with AI for fintech can save time and effort.

AI may assess an invoice, search for duplicates, and do further checks to verify its legitimacy, enhancing the finance process’ overall efficacy.

Thus, a company’s cash flow can be increased with the assistance of fintech application developers, allowing it to grow and make operational investments.

Use our AI-powered solutions for unmatched customer satisfaction.

Real-world Applications of AI and ML in Fintech

Artificial Intelligence and machine learning are essential resources in the rapidly evolving field of finance technology, transforming how companies run and interact with their clients.

Let’s examine a few real-world examples that are influencing the fintech industry:

Chatbots and Virtual Assistants

Fintech companies frequently use chatbots and virtual assistants to improve customer service. These AI-powered financial solutions can help with account management, answer consumer questions promptly, and direct users through various financial procedures.

For example, a virtual assistant can assist customers with checking account balances, starting transactions, and offering investment recommendations based on the user’s financial history and interests.

Algorithm Testing

Algorithmic trading makes considerable use of AI and machine learning techniques. These algorithms find trading opportunities and execute trades at the best times by analyzing enormous volumes of financial data in real time.

AI for fintech is also used to backtest trading techniques with historical data, which enables businesses to evaluate the profitability and viability of different trading algorithms.

With the use of AI in trading, the financial markets have undergone a revolution that has made trading choices faster, more accurate, and more automated.

Insurance Underwritingx`

Artificial intelligence (AI) and machine learning algorithms evaluate the risks of insuring people or property in insurance underwriting.

To give precise risk estimates, these algorithms examine a variety of variables, such as lifestyle choices, medical history, and personal information.

By eliminating manual processing time and lowering the possibility of errors, this automation results in underwriting decisions that are made more quickly and accurately.

Credit Scoring

Fintech companies use AI and machine learning models to assess a person’s or a business’s creditworthiness. These models examine various data elements to produce credit scores, including income, spending patterns, credit history, and outstanding debt.

By improving credit evaluations’ accuracy through automation, loan approvals and interest rate calculations can be more accurate. Additionally, it makes it possible for financial organizations to lend money to more kinds of people.

Customer Behavior Analysis

Customer activity patterns are analyzed through the use of AI-driven customer experience analytics. This involves awareness of one’s spending tendencies, preferred investments, saving strategies, and other financial endeavors. Subsequently, the information is utilized to customize offers and recommendations.

By acquiring comprehensive insights into client behavior, fintech companies may offer tailored products and services, improving customer satisfaction and increasing retention rates.

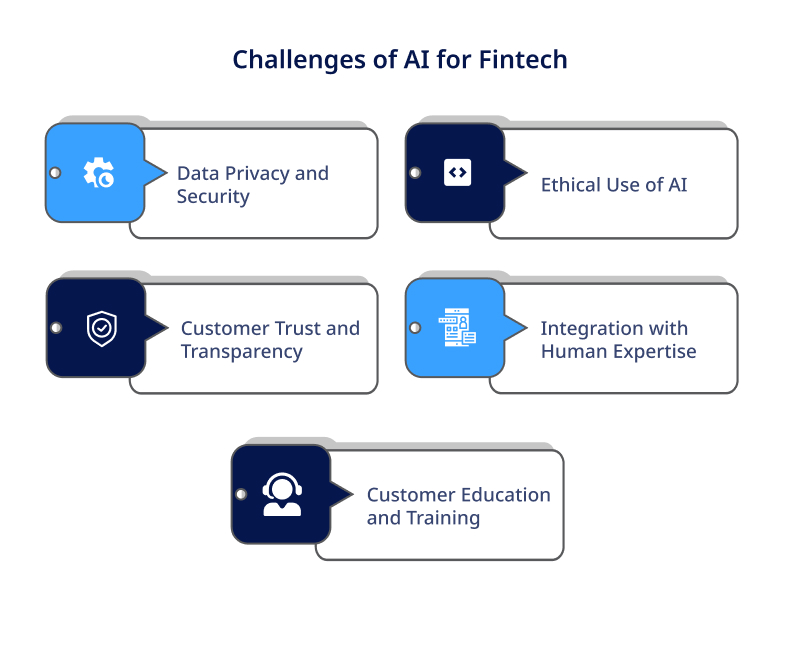

Challenges and Consideration for Fintech Firms in Deeping Customer Relationships with AI

Harnessing the potential of AI to foster deeper customer relationships can be strategic. However, it comes with its own set of challenges and critical considerations that demand careful attention.

Here are the key factors fintech firms address the challenges of AI for Fintech:

Data Privacy and Security

Challenge: Data security and privacy are critical since fintech companies handle sensitive financial data. Protecting this data from hacker attacks, illegal access, and breaches is the difficult part.

Consideration: Fintech companies must put strong encryption, multi-factor authentication, and access limits in place. Conducting regular security assessments and adhering to industry requirements (such as CCPA, GDPR, and others) is crucial.

Furthermore, it is essential to teach staff members and clients about data security best practices.

Ethical Use of AI

Challenge: Although automation can potentially improve customer experiences, there is a concern that it will replace human engagement in consumer interactions too much. Biased algorithms may lead to discrimination or unjust treatment of particular clientele groups.

Consideration: Fintech companies should set moral standards for AI applications, ensuring that algorithms are created impartially and equitably. They must balance automation and human engagement to offer a customized and sympathetic experience.

Training AI development teams and staff members on ethical AI applications is essential to guarantee compliance with moral standards and client expectations.

Customer Trust and Transparency

Challenge: Using Artificial Intelligence in financial services could lead to privacy and data security issues. Consumers want to know that their private information is treated with the highest care.

Consideration: Fintech companies should prioritize maintaining open lines of communication about the application of AI, ensuring that data protection laws are followed, and offering explicit privacy policies. It is crucial to establish trust by open and honest methods.

Integration with Human Expertise

Challenge: It can be difficult to balance human expertise and AI-driven automation. If AI is used excessively without human supervision, subtleties or particular client situations could be overlooked.

Consideration: Fintech companies must build AI systems that cooperate with human professionals. While humans manage complex events and offer emotional intelligence and nuanced understanding that AI may lack, AI can undertake regular chores.

Customer Education and Training

Challenge: Clients may be unfamiliar with using AI-powered financial services products. They might need instruction on the proper usage of these tools.

Consideration: To aid consumers in navigating AI-powered features, fintech companies should allocate resources towards creating user-friendly interfaces, offering tutorials, and providing customer assistance.

Consistent communication and instructional resources help ensure clients feel comfortable using these tools.

PixelCrayons and its AI services for Fintech Firms

PixelCrayons is a leader in innovative AI services designed specifically for finance companies. We enable financial technology companies to transform processes, improve client experiences, and spur corporate growth by utilizing artificial intelligence. Here are some key offerings:

AI-powered Chatbots and Virtual Assistants: We use AI-powered chatbots and virtual assistants to expedite inquiries, improve customer service and answer frequently asked questions promptly.

Fraud Prevention and Identification: We use AI algorithms to quickly identify anomalies, possible fraud, and suspicious activity to protect financial transactions and maintain security.

Customer Segmentation and Personalization: We use AI-driven data to segment your consumer base according to their demographics, tastes, and behavior. This makes it possible to create and offer highly customized marketing strategies.

Predictive Analytics for Risk Assessment: We evaluate risk variables, forecast market trends, and make well-informed lending and investing decisions.

Algorithmic Trading Solutions: We create AI-powered algorithmic trading platforms that use data to inform investment decisions, automate trading methods, and optimize portfolios.

Explore AI-driven solutions for a personalized and seamless customer journey

Customer Relationship with AI in Fintech: What Is the Future?

Artificial intelligence in the fintech sector has enabled advancements in automation, efficiency, security, and fraud detection, transforming the financial sector.

Fintech AI has a bright future with continued advancements and the appearance of new uses. Businesses in the financial sector will benefit from a competitive edge and improved client service if they employ AI effectively.

A fintech application development company should adopt a data-driven approach and promote close collaboration between the technical and business teams if it wishes to deploy AI. By following these best practices, fintech companies can make the most of AI and ML and thrive in the rapidly evolving financial industry.