Struggling with sluggish financial software hindering your institution’s growth?

Outdated financial systems hold you back in a landscape demanding swiftness and innovation. The need for agility and cutting-edge solutions has never been more critical.

Embark on a transformative journey with our step-by-step guide to financial software development. Reshape your strategy, enhance client experiences, and position your institution as a pioneer in the digital era.

Table of Contents

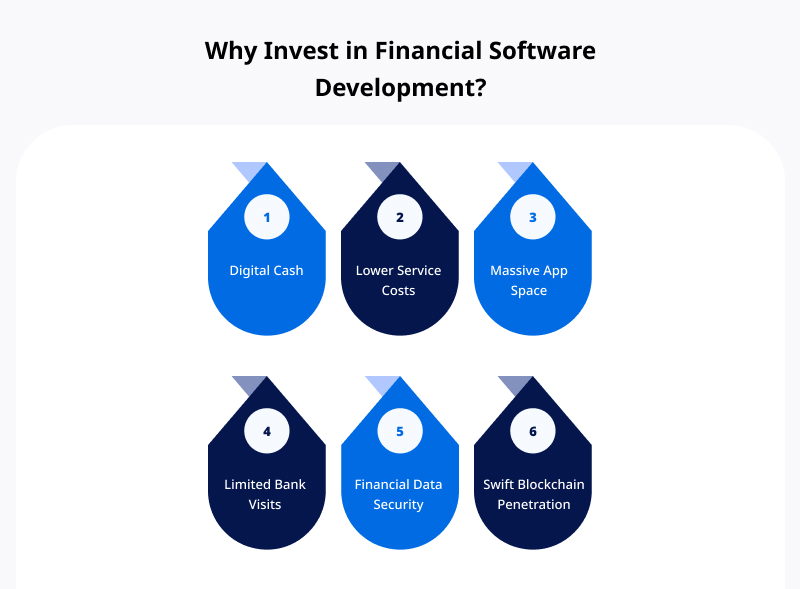

Top Reasons to Invest in Financial Software Development

Investment in financial software development has become essential for organizations that want to stay competitive and satisfy the growing expectations of tech-savvy clients.

Organizations are allocating resources to this transformative domain for the following reasons:

Digital Cash

Investing in software development for financial services unlocks the possibility for digital currency solutions, such as cryptocurrency and digital payment systems.

These developments meet the needs of contemporary consumers by providing safe and effective substitutes for conventional cash transactions.

In an increasingly digitalized world, companies that embrace digital cash position themselves at the forefront of financial technology and meet customer demand for cashless transactions.

Lower Service Costs

Investing in financial software app development allows typical manual processes in financial operations to be automated, which results in attractive cost-efficiency gains. This automation reduces the need for manual work, lowers the possibility of mistakes, and improves operational effectiveness.

Robust financial software deployment enables efficient resource allocation, improved workflows, and effective technology utilization, resulting in notable and long-lasting cost reductions.

This cost-effectiveness makes financial software an attractive investment for companies, allowing them to improve financial operations and maintain competitiveness in a constantly changing market.

Massive App Space

Putting money into financial software development allows you to take advantage of the growing app market created by the increasing use of mobile applications.

To meet various needs of software development for financial services, it includes investment management, mobile banking, and financial education.

With this investment, companies can reach a large user base and maintain their competitiveness in the digital market.

Limited Bank Visits

Financial software development is essential to reduce the need for in-person bank visits and adjust to shifting consumer behavior.

With the development of digital banking solutions and financial apps, users can now simply handle transactions and financial responsibilities without visiting a physical branch.

By investing in strong financial software app development platforms, businesses may adapt to changing consumer preferences for convenient and effective financial services.

Financial Data Security

Financial software app development is an essential investment to guarantee strong financial data protection.

In the digital realm, sophisticated security protocols are important, and financial software development facilitates the implementation of access controls, secure authentication, and encryption by enterprises.

This fortification guarantees regulatory compliance, protects financial data, and fosters user trust.

Swift Blockchain Penetration

Blockchain technology and financial software development services enhance security and transparency. It lessens reliance on middlemen while enabling quicker, safer, and more affordable financial activities.

Companies that invest in blockchain-integrated financial software application development services are well-positioned to spearhead ground-breaking innovations in the financial industry.

Dive into seamless financial software development with PixelCrayons' expert services. Unlock the potential and reshape the future with us.

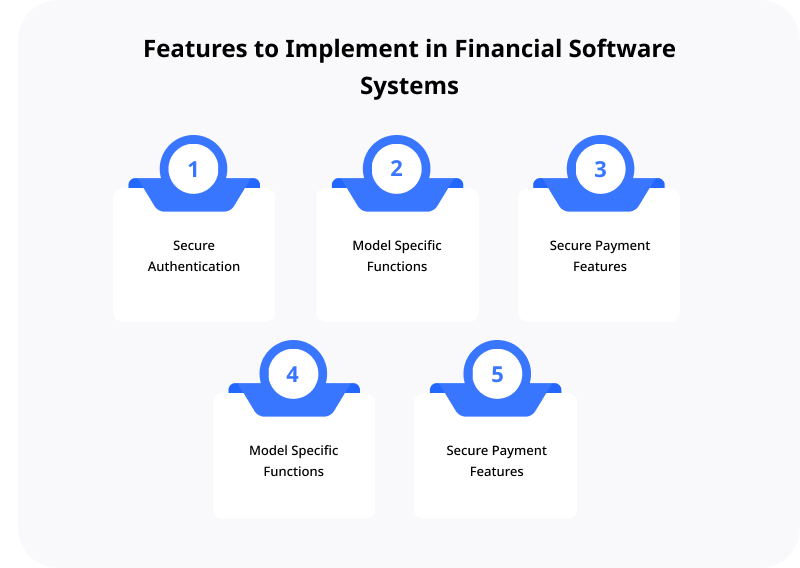

Key Features to Implement in Financial Software Systems

Financial software systems are pivotal in modernizing and streamlining business financial operations. Implementing key features is essential to ensure optimal functionality, security, and user satisfaction.

Below are crucial features that contribute to the success of financial software systems:

Secure Authentication

A vital component of financial software systems is secure authentication, which guarantees the security of private user information and thwarts illegal access. This feature strengthens the financial application’s security posture by using strong procedures to verify users’ identities.

- To increase security, multi-factor authentication (MFA) asks users to provide many kinds of identity, including passwords, fingerprints, or security tokens.

- By using information such as fingerprints or face recognition, biometric authentication improves accuracy and provides a safe method for users to access financial systems.

- Users and financial software can communicate encrypted thanks to encryption protocols like SSL/TLS, which protect sensitive data while it’s being transmitted.

Model-Specific Functions

Financial software created to specifically address the requirements and workflows of a financial institution or organization is referred to as having model-specific functions. This modification makes the software precisely match the company’s particular needs, offering a more effective and efficient way to manage financial operations.

- It requires users to provide multiple ways of identification, such as passwords, fingerprints, or security tokens. It works as an additional tier of security.

- Using information like fingerprints or face recognition, biometric authentication enhances accuracy and provides a safe method for users to access financial systems.

- Users and financial software can communicate encrypted thanks to encryption protocols like SSL/TLS, which protect sensitive data while it’s being transmitted.

Secure Payment Features

Secure payment methods are essential for financial management apps to maintain user trust and safeguard confidential transaction data. Payment features incorporate comprehensive tactics to prevent fraud and unauthorized access in addition to encryption-based security measures. There are three main points to consider:

- To secure payment data from the time of entry to processing and storage, use strong encryption techniques.

- Incorporate multi-factor authentication techniques to give payment transactions extra protection.

- Use tokenization techniques to create unique tokens in place of sensitive payment data.

Insightful Dashboard

A key element of financial software systems is an intelligent dashboard, which offers users an extensive and intuitive interface for tracking and analyzing financial data. The dashboard is a central location to obtain important insights supporting well-informed decision-making.

When putting an insightful dashboard into practice, keep these three things in mind:

- Give customers the option to alter the layout of their dashboard by adding, deleting, or moving widgets around to suit their tastes.

- Make sure that modifications to the financial data are shown in real-time or very real-time on the dashboard.

- Include interactive elements that let visitors delve deeper into particular data points to understand better.

Real-Time Alerts and Notifications

Real-time alerts and notifications are essential components of financial software systems in the fast-paced world of financial operations. These features facilitate quick decision-making and improve the user experience by ensuring that users and stakeholders are promptly informed about important occurrences.

- By reducing risks and seizing opportunities, real-time alerts enable quick, well-informed decisions in reaction to shifts in the market, transaction confirmations, or security alerts.

- By providing pertinent information instantly, users become more involved in their financial affairs and develop a sense of trust in the software system.

- Real-time alerts are an effective tool for preventing fraud and mitigating risk because they rapidly advise users of suspicious activity or odd transactions, thereby averting potential financial losses.

Leverage PixelCrayons' services to propel your financial software development and redefine the landscape of financial technology.

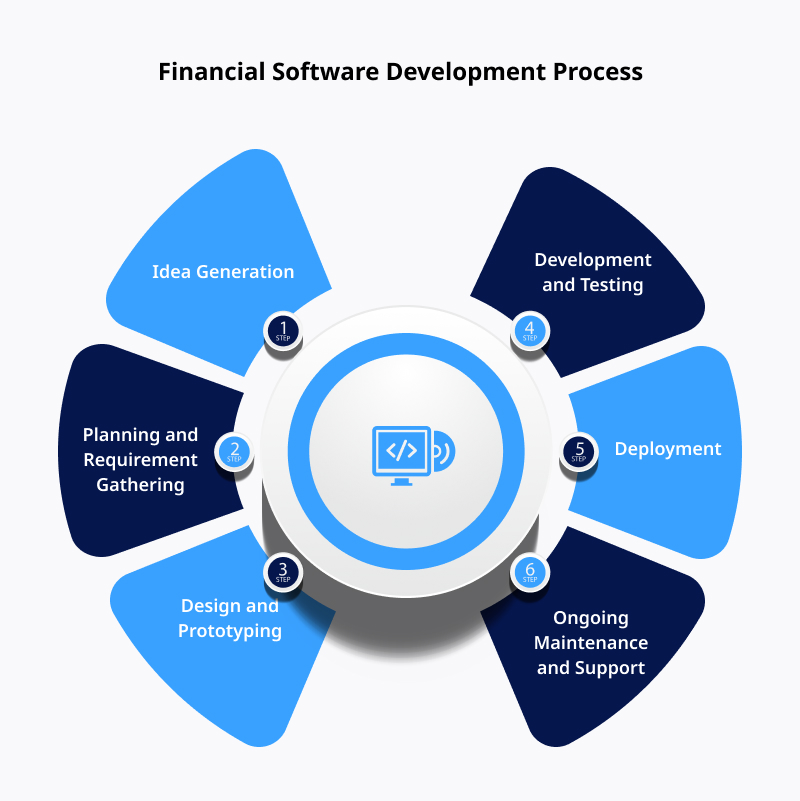

Step-by-Step Guide to Financial Software Development

Financial software development steps can be broken down into key phases, each necessary for the program to grow and function properly. Let’s explore each step of the exciting process of developing dependable and efficient financial software.

Step 1 – Idea Generation

The financial software development process concept creation phase aims to produce innovative and unique ideas for the program’s features, functions, and overall design.

This stage includes gathering information, comprehending the target audience’s demands, taking care of issues, and suggesting possible solutions.

Establishing the software’s development framework through due diligence, market research, and stakeholder input guarantees that it satisfies the particular requirements and goals of the financial industry.

Step 2 – Planning and Requirement Gathering

It calls for conducting in-depth research, receiving input from stakeholders, and being aware of the needs and expectations of end users. Recorded are use cases, user stories, and functional and non-functional requirements.

The planning step also involves creating a project timeframe, allocating resources, and developing a development roadmap. It ensures the final product meets the specified goals by laying the groundwork for the software development process.

Step 3 – Design and Prototyping

Another important goal is to represent the software’s user interface and experience visually. Based on the requirements and specifications, developers and designers collaborate to produce interactive mockups, wireframes, and prototypes.

This step defines the software’s user interface, functionality, and design to offer a simple and easy-to-use experience. At this point, usability, accessibility, and branding are also considered by designers.

The prototype is a physical depiction of the software’s functioning, and before proceeding with the development phase, the stakeholders can provide feedback and make the required changes.

Step 4 – Development and Testing

At this point, the primary priorities for the stated requirements and design are coding and software implementation. Software modules are built, code is created, and developers incorporate the required functionality.

This stage involves extensive testing to ensure the program functions as intended and satisfies the necessary quality requirements. Testing has several forms: system, integration, static, and unit.

This process includes locating, identifying, and resolving any issues or faults. The financial software is designed and rigorously evaluated at this critical step to ensure its dependability and efficiency.

Step 5 – Deployment

Right now, the sole priorities are getting the program into users’ hands and ensuring it works properly. It is accessible to the intended audience after the financial software is deployed.

Under this step, monitor the performance, fix bugs, and give regular updates to increase the functionality and security of an application.

During this phase, the lifetime dependability and security of the financial software are guaranteed.

Step 6 – Ongoing Maintenance and Support

This phase’s main objective is guaranteeing the software’s ongoing operation, performance, and user satisfaction. After installation, the program corrects any errors, glitches, or difficulties.

Updates and patches are frequently published to improve the software’s security, stability, and compatibility with new technologies. A committed support staff is available to help users, offer technical advice, and respond to any questions or issues.

The financial software is dependable, efficient, and user-focused because of constant software support and maintenance.

Take the leap towards financial innovation! Discover financial software development and harness PixelCrayons' expertise for unparalleled success.

How Can PixelCrayons Help in Financial Software Development?

PixelCrayons is one of the top providers of mobile app development services designed to meet the demands of the finance industry. Our organization specializes in providing top-notch solutions for financial software development.

Our team collaborates to understand their specific requirements, whether developing custom financial applications, implementing secure payment gateways, or enhancing existing financial systems.

We assist businesses in increasing operational efficiency and streamlining their financial processes, emphasizing data protection, compliance, and user-centric design. Get in touch with us to remain ahead of the ever-changing financial technology scene.

The Bottom Line

To put it briefly, building financial software for the FinTech industry involves several steps, including planning, designing, prototyping, developing and testing, maintaining, and deploying the final product.

Each stage is critical to designing reliable and user-friendly software development for startups and large businesses. Collaborating with FinTech application development companies might greatly benefit your firm.

We can assist you most effectively. Connect with us for continuous upkeep and assistance to guarantee the software’s peak efficiency and user contentment.